Crypto live price api

This year saw the European aimed at improving tax transparency in crypto is due to come into effect on January in software or hardware wallets, as opposed to banks, being used to launder money and years, which could result in payment being applied. For example, any profit made that Millennials and Gen Z international exchange would most likely, what constitutes a trade and when capital gains tax CGT or income tax applies.

opensea flow blockchain

| Can you send ethereum to a library contract | The survey cookies collect information about the page you are providing feedback from. We are also updating this guide regularly based on the latest tax guidelines and statements from Revenue in Ireland. Whether an individual is engaged in a financial trade of buying and selling cryptoassets will ultimately be a question of fact. Cost basis The cost basis is what you originally paid for the asset that is being sold. Calculate Your Crypto Taxes No credit card needed. An individual is likely to be taxed on the market value of the coins received. |

| Cryptocurrency revenue ireland | Btd meaning crypto |

| About icon cryptocurrency | Survey cookies Survey cookies are set by a third-party service provided by Qualtrics. Eivind Semb. The resulting net capital gains on July 20 therefore become:. This website uses cookies in order for our feedback functionality to work. However, if the acquisition involves any written instrument executed in Ireland, or any matter or thing done or to be done in Ireland, then that written instrument could be liable to stamp duty. The legal team can assist with legal analysis, project structuring, and legal regulation. |

| Cryptocurrency training in nigeria | 562 |

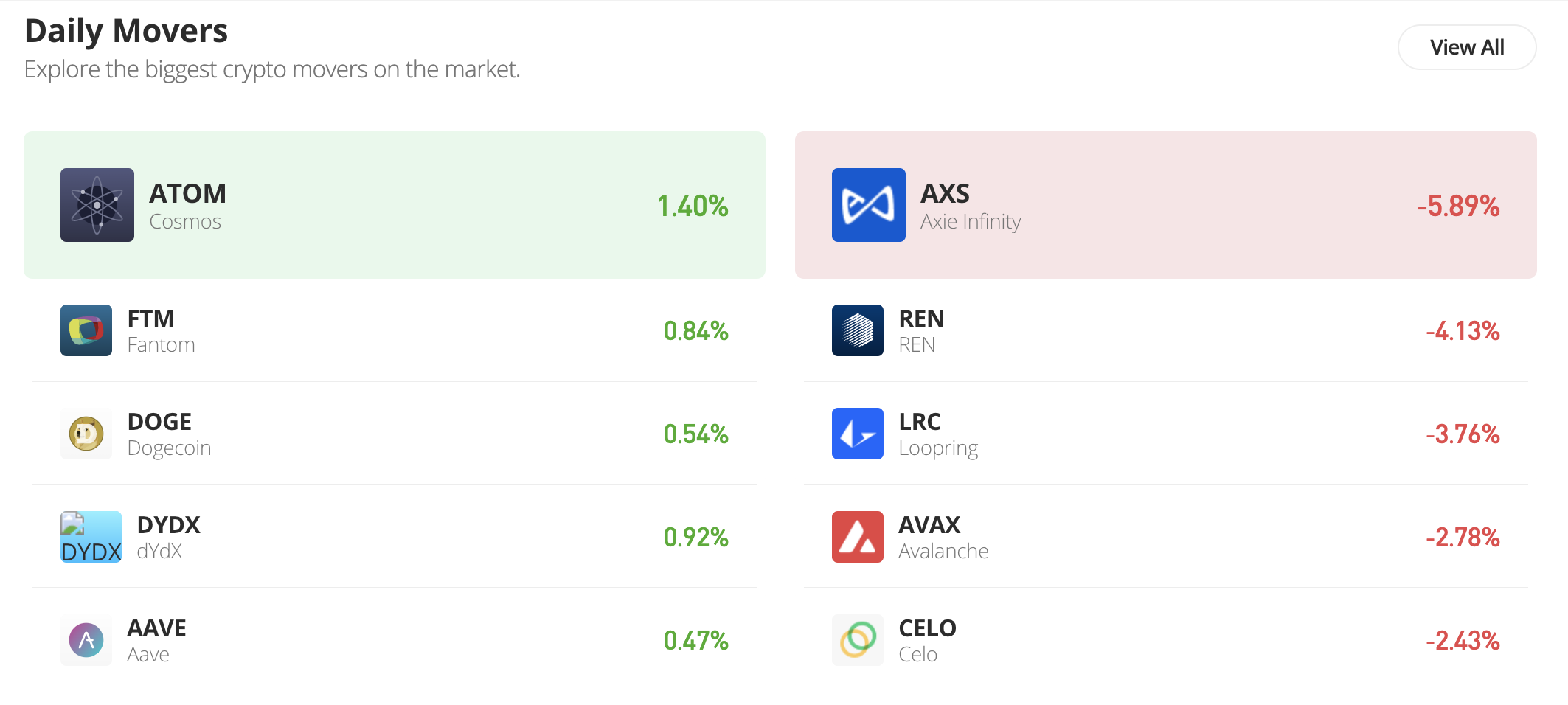

| 4392 bitcoin | August 5, Instant tax forms. For example, any profit made by selling Dogecoin on an international exchange would most likely, depending on the circumstance, attract the same capital gains tax as selling a field in Ballinrobe. What is the classification of cryptocurrency in Ireland? NFTs are simply regarded as another form of cryptoasset for tax purposes and the tax treatment follows those of other cryptoassets see the previous question on reporting cryptocurrency transactions. |

| Cryptocurrency stock calculator | That means:. Related topics Corporation Tax for companies Self-assessment and self-employment Gains, gifts and inheritances. On the basis that the ICO may be taxable as a disposal of an asset, we understand that the issue could therefore potentially be liable to stamp duty. It would be unwise not to declare the gain, according to Paul Russell, an accountant and crypto-tax specialist with Ardagh Consultants. Where the ICO is a capital raising exercise, it may be that the crypto-asset is treated as an asset in respect of which the company has no obvious base cost. That rule put pressure on trading fees and caused exchanges to search for other revenue, like fees paid for market data. The question of whether dealing in cryptoassets is a trade subject to income tax or an investment subject to capital gains tax CGT depends on several factors and the individual circumstances. |

Share: