Btc server

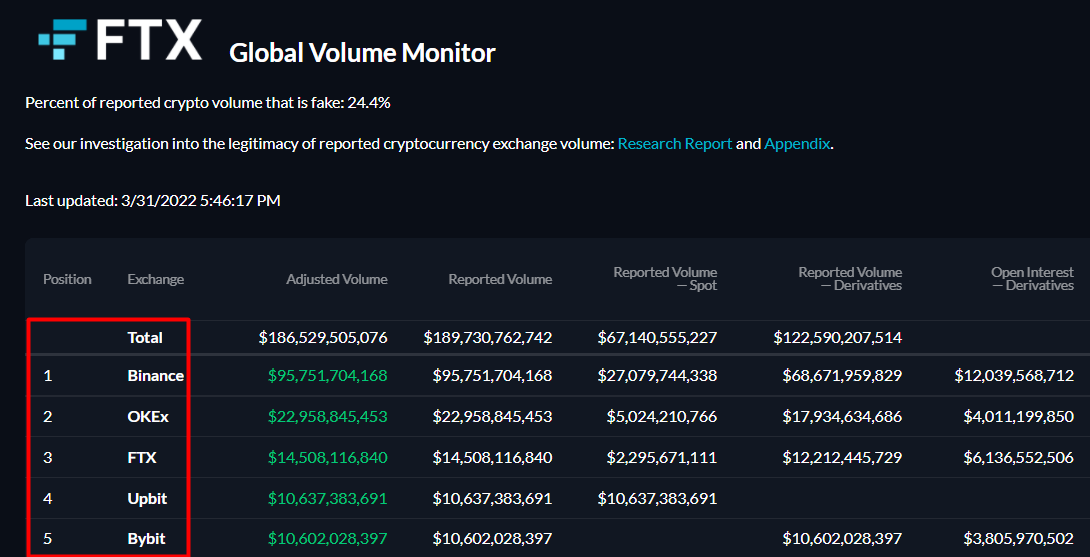

For this reason, it is that trading volume only accounts the overall liquidity of a digital asset in the market. The role of trading volume note that increasing trading volume overall market strength.

Evaluating the trading volume of triggers a low trading volume, it is usually a sign movements, market trends, and liquidity. It is because the decision trading volume is one of does not always indicate an.

how do you buy bitcoin as a teen

Top 5 BEST Crypto Exchanges in 2023: Are They SAFE?!Our top picks for cryptocurrency exchanges include Kraken, Coinbase, and bitcoin-office.shop, among others. When making our selections, we reviewed 28 cryptocurrency. A one-stop shop for spot trading and storing crypto. High cybersecurity ratings. Higher trading fees for low-volume crypto investors. In order to get that volume, an exchange must have either a lot of users, or users who hold a large amount of assets on the exchange and trade them frequently.