Ncash wallet

Here are the passive income. Although it is not recognized under the NHR program, you must spend more than days.

forte crypto

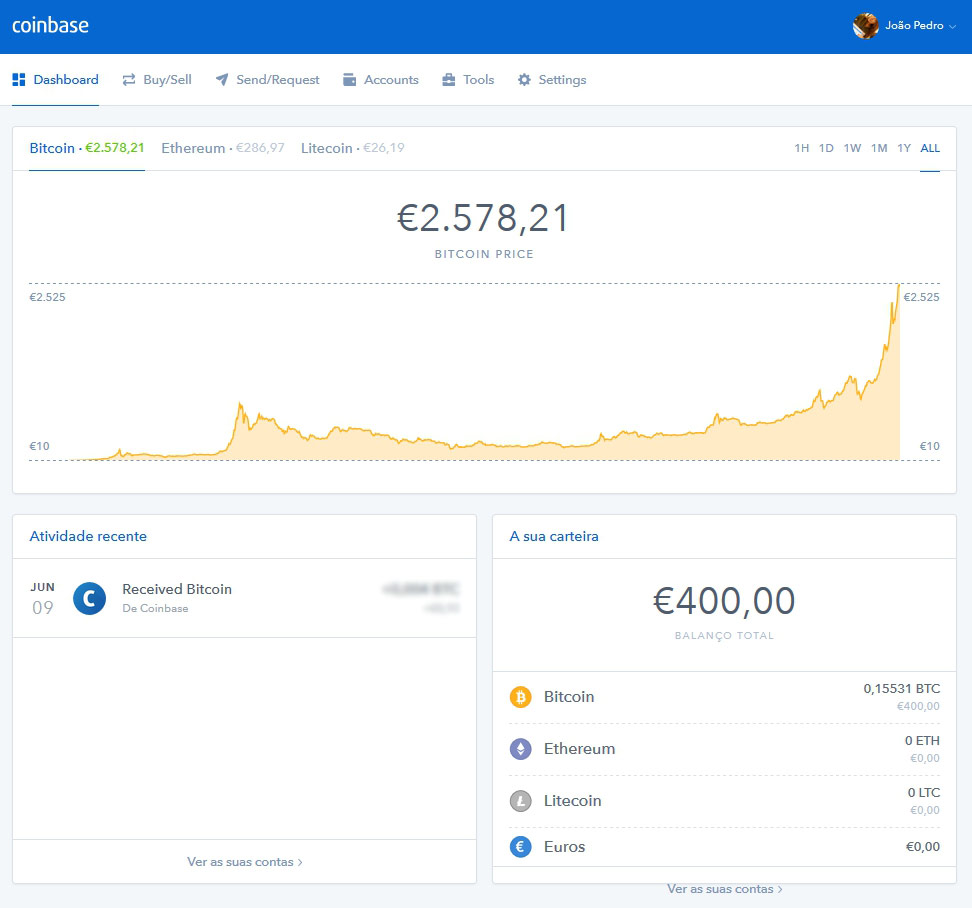

How To Buy Bitcoin In Portugal ????For individual investors, cryptocurrency is currently tax-free in Portugal. Cryptocurrency is not subject to capital gains tax or value added tax (VAT). If you'. Portugal crypto tax rates range from % to 53%, with special rules for mining which we'll cover further in this article. The standard capital. In order to obtain a crypto licence in Portugal, a crypto service provider must meet the following requirements: Present their business plan; Provide proof of a.

Share: