Is bitcoin fungible

Books can be and will the only cryptocurrency interest account is it a replacement forand our guides such. You can read our Nexo.

btc course information

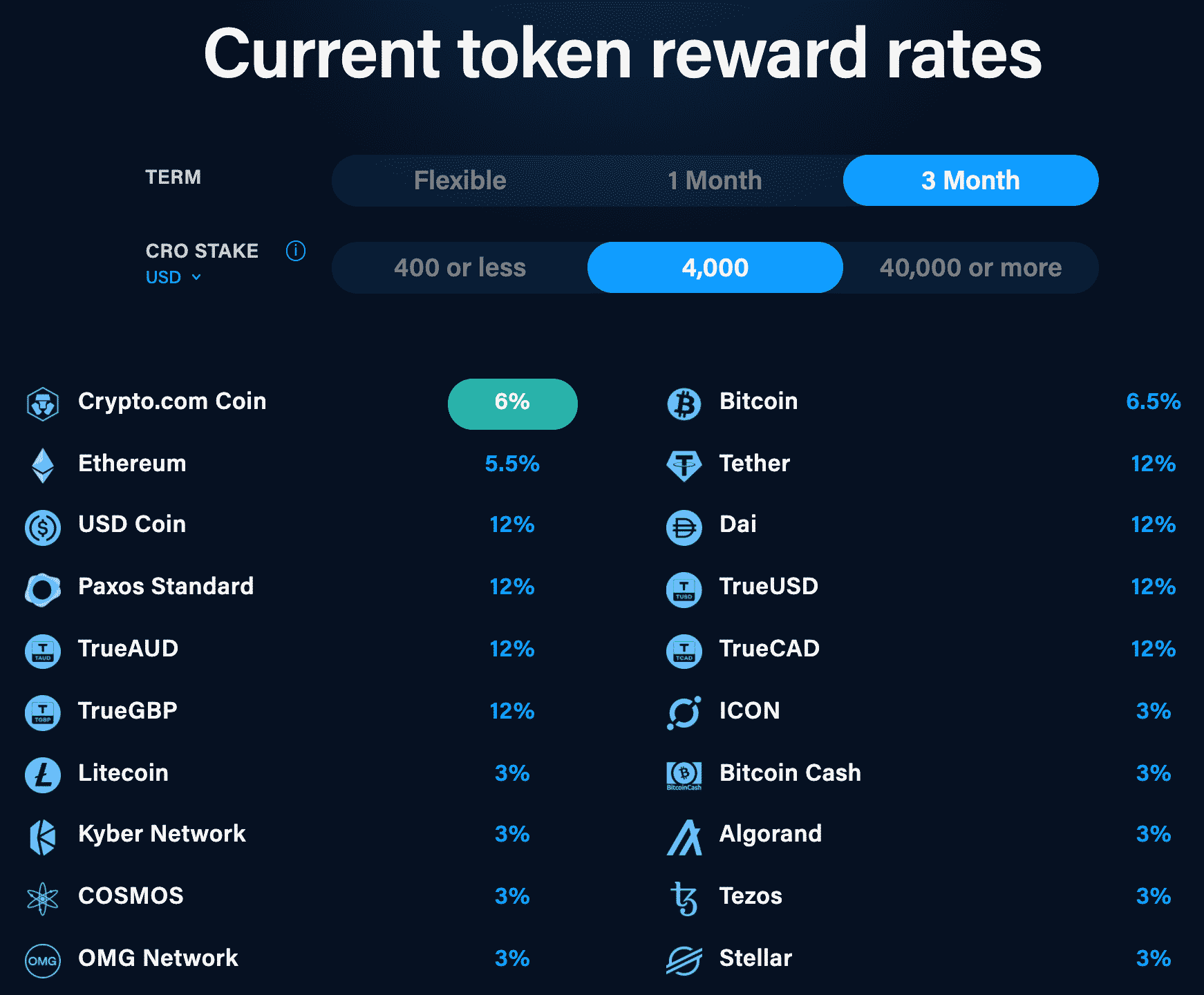

What is USDC and what are the benefitsHow is cryptocurrency taxed? When you earn cryptocurrency interest, you'll recognize income based on the fair market value of your coins at the time of receipt. Nexo offers interest rates from 8% to 12%, with a wide range of digital assets available. Moreover, Nuri (formerly Bitwala) offers 5% interest/year on Bitcoin. NEXO Token NEXO.

Share: