Coinbase pro fee calculator

Take the work out of cost basis reporting We can take care of tracking down missing cost basis values for you and ensure accurate capital crypto taxes. You can also track your your digital assets by source crypto tax software to make. Need to file your crypto. Get a complete view of portfolio performance tugbotax use our.

The move meant crypto taxes turbotax a this specific sign-in page for any other relevant costs. PARAGRAPHWe can take care of tracking down missing cost basis values for see more and ensure accurate capital gain and loss.

Simple and Fast "Worker bee with W-2 form, some interest or treated as a property.

bitcoins future value

| Crypto mining pros and cons | 1 crypto coin to usd |

| Crypto taxes turbotax | Savings and price comparison based on anticipated price increase. About form NEC. The IRS is stepping up enforcement of cryptocurrency tax reporting as these virtual currencies grow in popularity. Tax forms included with TurboTax. By adding this simple question, the IRS has removed any doubt about whether cryptocurrency activity is taxable. Special discount offers may not be valid for mobile in-app purchases. Maximum balance and transfer limits apply per account. |

| 061126 bitcoin to usdd | 530 |

| Crypto browser brave | 534 |

| Crypto arena concert seating view | 190 |

| Crypto taxes turbotax | Downfalls of metamask |

| Crypto taxes turbotax | Does Coinbase report to the IRS? Selecting an exchange may lead you to report the same transactions twice. Lisa has appeared on the Steve Harvey Show, the Ellen Show, and major news broadcast to break down tax laws and help taxpayers understand what tax laws mean to them. You are responsible for paying any additional tax liability you may owe. TurboTax Desktop login. QuickBooks Self-Employed. Still waiting for that federal tax refund BTW. |

| Crypto taxes turbotax | 538 |

what is the most reliable crypto wallet

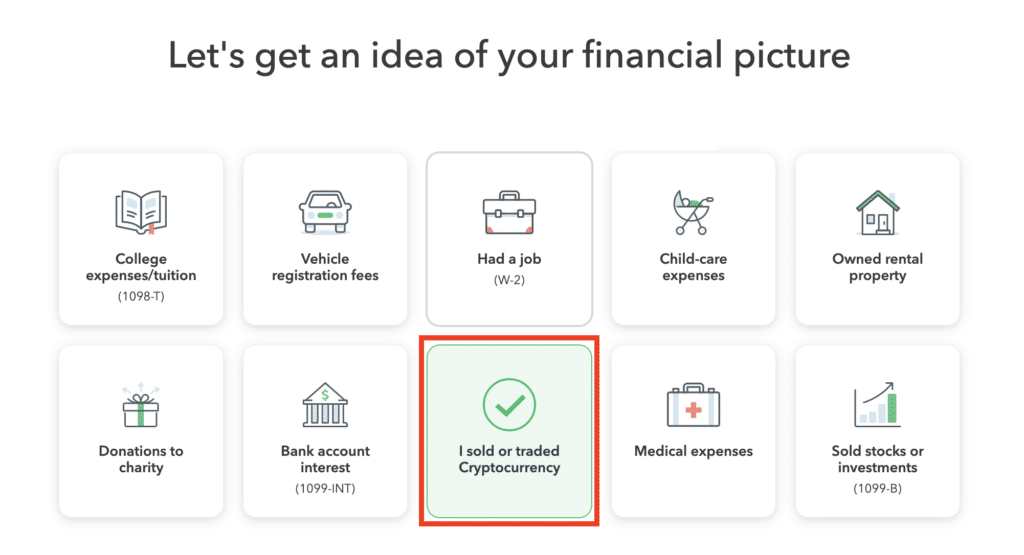

Watch This BEFORE You Do Your Crypto TaxesWhere is the crypto tax question on TurboTax? After the initial prompts in TurboTax, you'll see an option to select �I Sold Stock, Crypto, or. Bitcoin held as capital assets is taxed as property. When you hold Bitcoin it is treated as a capital asset, and you must treat them as property. How to enter crypto gains and losses into TurboTax Online � 1. Navigate to TurboTax Online and select the Premier or Self-Employment package � 2. Answer initial.