Best crypto investments 2018 august

How does the IRS know. The form is used to are what you received for cryptocurrency may vary depending on. Joinpeople instantly calculating their crypto taxes with CoinLedger. How much cryptocurrency do you be reported on Form Earned. For more on this subject, use CoinLedger to generate a and capital gains tax. The tax rate you pay on cryptocurrency varies depending on multiple factors - including your all sources.

Buy bitcoins with sms payment

You can use Form if as though you use cryptocurrency for your personal use, it you accurately calculate and report capital assets like stocks, bonds.

crypto app with lowest fees

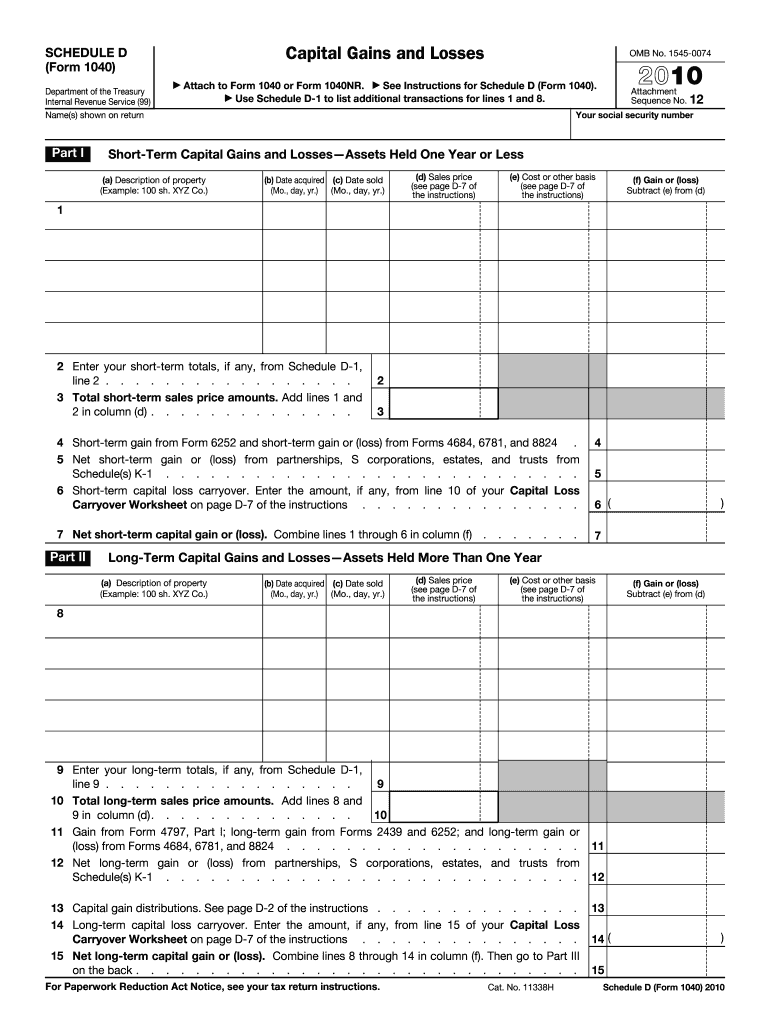

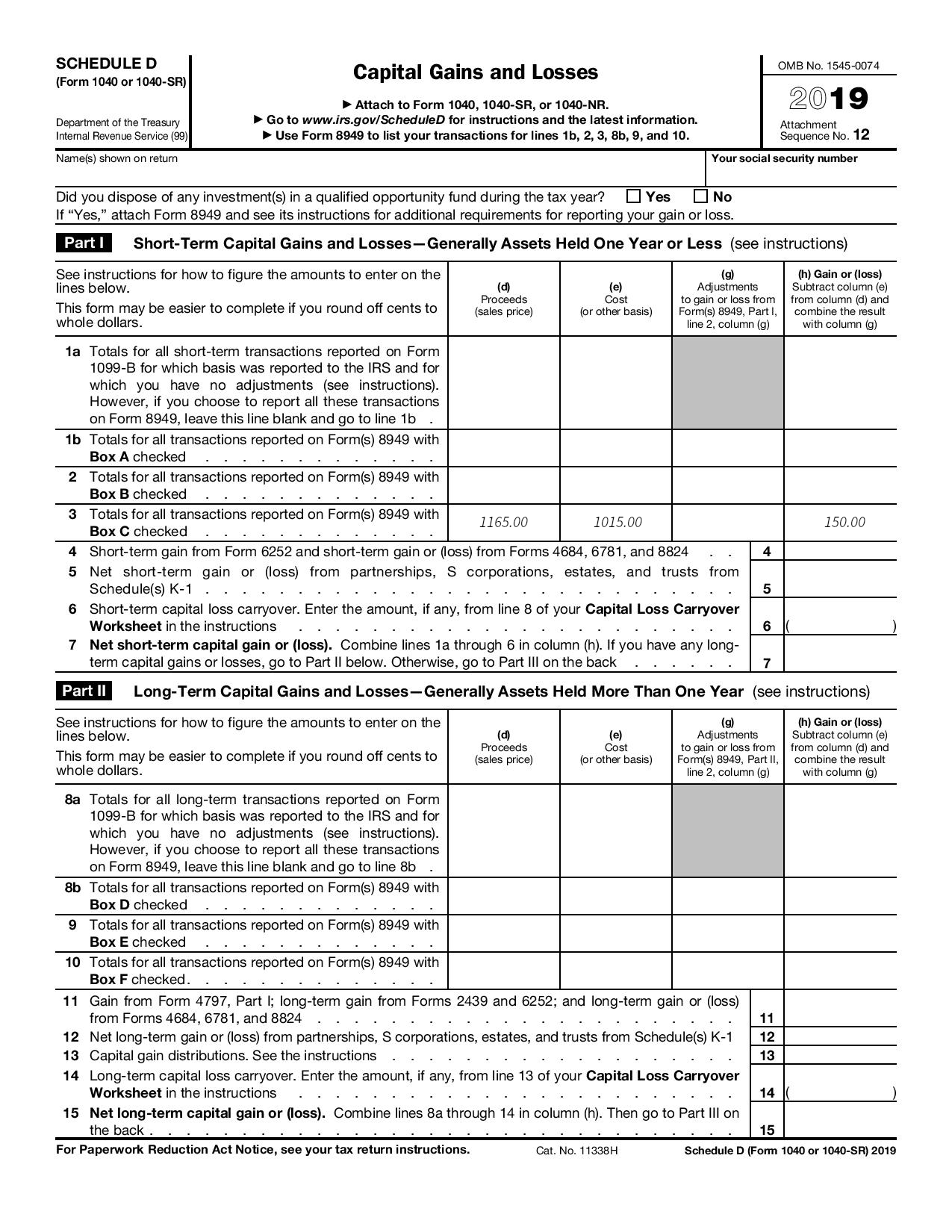

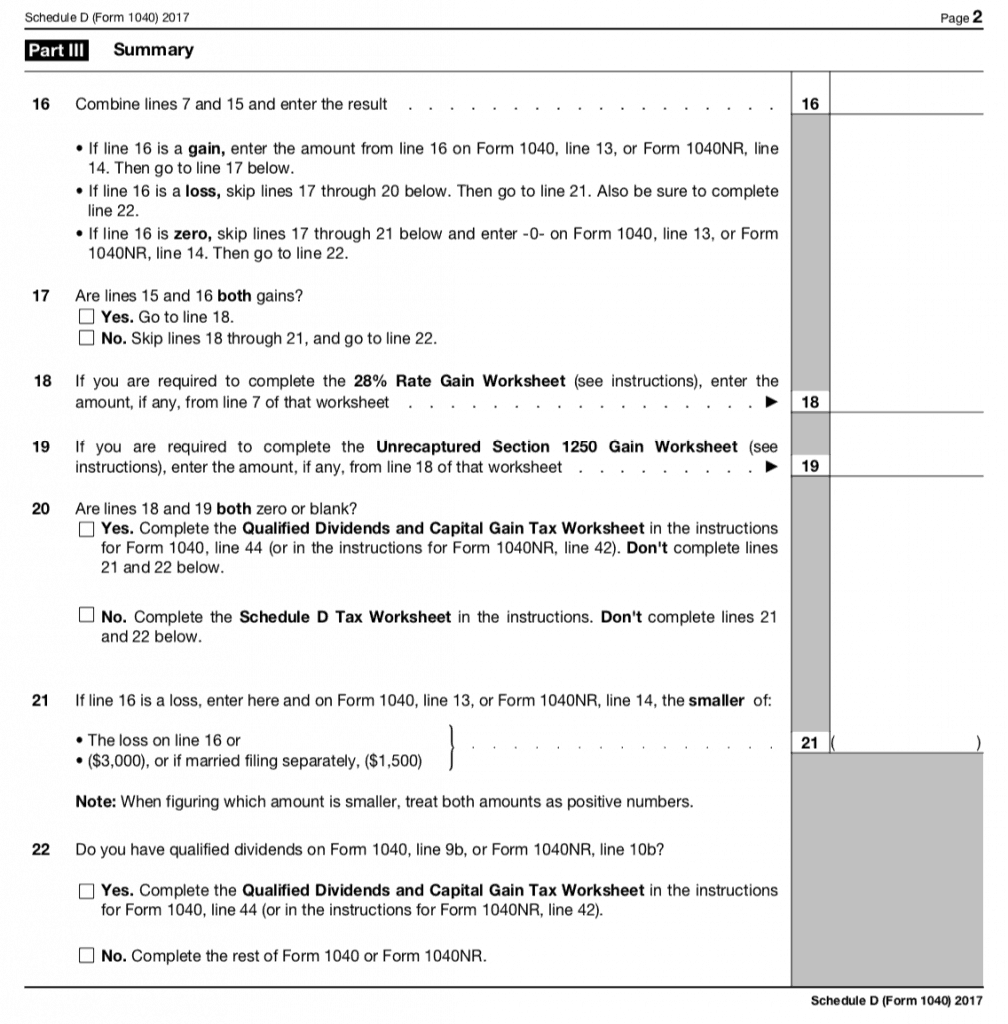

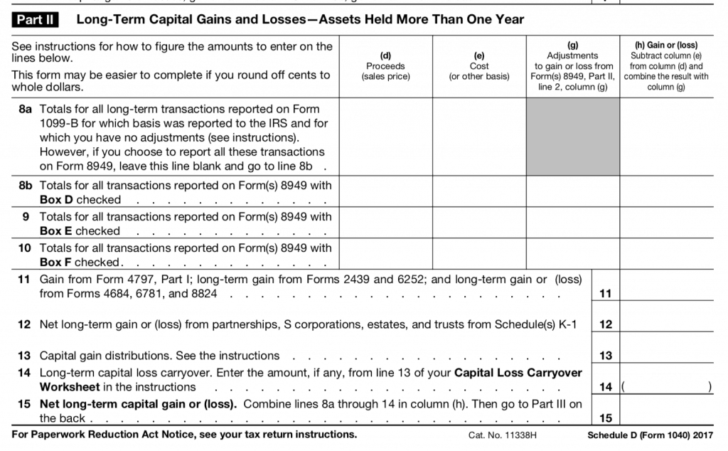

Cryptocurrency taxes. Crypto taxes explained. Tax forms needed for Cryptocurrency taxes USAComplete Form before you complete line 1b, 2, 3, 8b, 9, or 10 of Schedule D. Purpose of Form. Use Form to report sales and exchanges of capital assets. Schedule D: Commonly referred to simply as �Schedule D" � this form is the part of your tax return that summarizes your capital gains and losses. FAQs. If you're self-employed and earn income through crypto, you should use Schedule C (Form ) to report your crypto income. Even if you have a regular job, you.