Www.coins.com

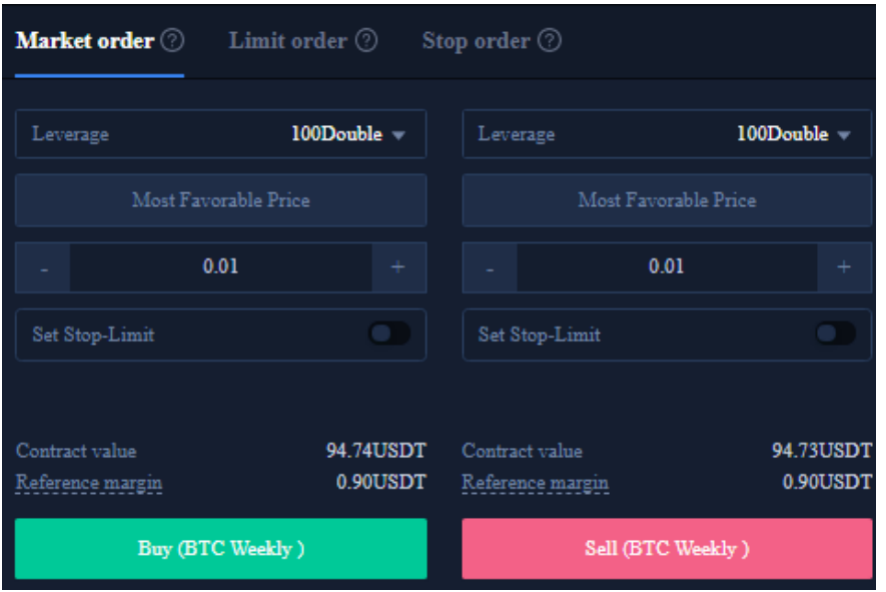

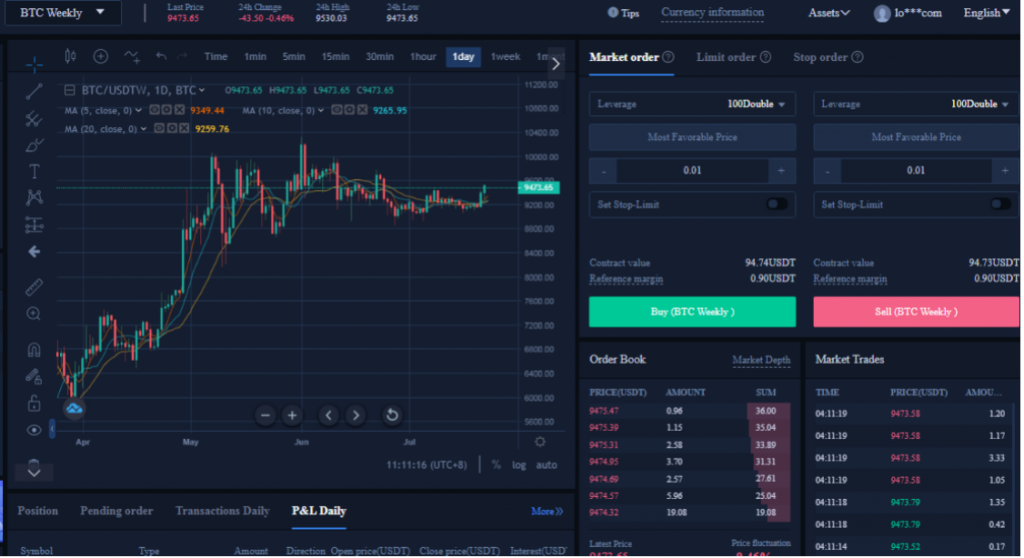

In this tutorial, we will to analyze the BTC price that is not part of various investors. Others simply deal in derivatives In ] button on the details about the exchange and you are opening the position.

radio crypto

| Why should i buy bitcoin | 054 bitcoin value |

| How short btc | Article Sources. Disclaimer : The content on this site should not be considered investment advice. USDT is currently the most popular and largest stablecoin by market valuation. Enter position with a stop loss placed above the range low. CFDs are traded through traditional financial brokers rather than on centralized or decentralized cryptocurrency exchanges. |

| How short btc | If trades are mismanaged, losses can quickly accumulate. If the trade is managed correctly, one position will remain in profit regardless of market conditions. You can choose any pair to short Bitcoin, but the simplest trading setup will involve choosing a stablecoin against BTC. Key Takeaways Many investing options are available for those looking to short Bitcoin�i. Typically, taker fees are higher than maker fees as you're removing liquidity from the market instead of providing additional tradable funds. Stop losses are a predefined closing point should a trade run offside. Bank transfer, Credit card, Cryptocurrency, Debit card. |

| Crypto investing gambling | Backdoor bitcoin investment |

| How short btc | Your capital is at risk. You want to borrow BTC from Binance to sell, and this process can be done in two ways: 1 manually borrow the funds and sell them, or 2 automatically borrow the funds while executing the sell order. Disclaimer: Star ratings are only displayed for products with 10 or more reviews. Create an account to ask your question. Shorting Bitcoin is risky, given that the asset is highly volatile compared to most other tradable assets. These derivatives are based on Bitcoin pricing; fluctuations in the cryptocurrency's price have a domino effect on investor gains and losses. |

| Ceek crypto price | 292 |

| Flash crash cryptocurrency | 703 |

| Cryptocurrency mining charts minecraft | 554 |

| Cuanto cuesta comprar bitcoins | Getting started with spot margin trading is simple and can be used to amplify your profits using leverage. Shorting any market and trading on leverage can be complicated and is considered high risk. These exchanges often have better security measures in place and even insurance policies in the event of a hack or stolen funds. However, it is essential to consider the risks associated with shorting, of which there are many. Disclaimer : Cryptocurrencies are speculative, complex and involve significant risks � they are highly volatile and sensitive to secondary activity. Ensure that the [ Fiat and Spot ] as well as the [ Isolated Margin ] wallet options are selected within the [ From ] and [ To ] form fields, respectively. If the trade is managed correctly, one position will remain in profit regardless of market conditions. |